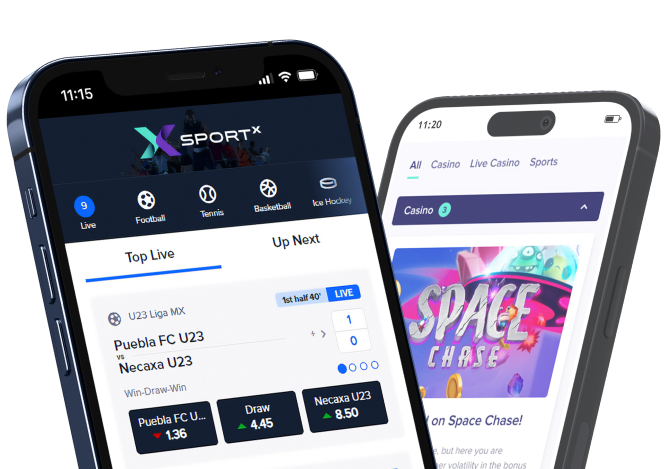

Discover the revolutionary X-suite

A new era of platform, sportsbook and AI technology.Revolutionary AI solutions

Innovative, real-time reporting and intelligent rules based solutions, built to maximise your acquisition and retention, powering results.

A new era of platform technology

Revolutionary, scalable and highly adaptable multi-jurisdictional platform technology, driving limitless growth for our partners.

Powerful new sportsbook technology

Powerful sportsbook specifically tailored and localised to your strategy, driving growth in the most complex regulated markets around the world.

Revolutionary AI solutions

Go Beyond the boundaries of traditional igaming tech. Define and create actionable business rules with on demand without the need for coding knowledge with our real-time rules engine.